photo credit: WordRidden via Compfight cc

On December 12, 2012, the Court of Special Appeals decided, in Meadows v. Easy Financing Corp., that a car finance company cannot rely on the terms of a stand-alone GPS agreement to require arbitration of a consumer’s claims relating to wrongful repossession practices.

G&M represented Anita Meadows in the case. Ms. Meadows’ car was repossessed by Easy Financing in May 2010, using a GPS system that automatically disabled the car when she missed a payment.

Ms. Meadows alleged that, in repossessing the car, Easy Financing failed to follow any of the procedures required by her loan agreement and by the Maryland statute the agreement invokes.

She filed suit against Easy Financing, but in November 2011, the Circuit Court for Baltimore County ordered the case dismissed on Easy Financing’s motion to compel arbitration.

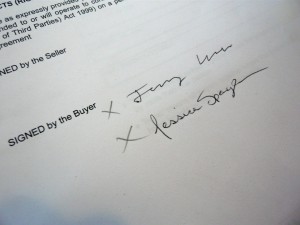

On appeal, G&M argued that Maryland law requires “an instrument in writing containing all of the agreements of the parties.” G&M argued that the “instrument” in question was the Retail Installment Sale Contract that contained loan terms and had no arbitration provision.

The Court of Special Appeals agreed, writing: “because the RISC is the only agreement that controls the transaction, the arbitration clause in the separate document should not have been enforced.”

A copy of the opinion can be downloaded here.

Share This: